In the structured world of accounting, understanding how to achieve accuracy and financial transparency is natural. A concept that underlines this system is "Normal Balance." Although it may look like a dry accounting term, it is a guiding principle that brings orders and arguments to the double-entry bookkeeping system. If you want to understand accounting and create an accurate financial model, then understanding the Normal Balance is your foundation.

What is a Normal Balance?

A Normal Balance refers to the side - Debit or Credit - where an increase in an account is recorded. Each account of a normal laser has a specified Normal Balance. This helps maintain balance stability and ensures that financial statements are properly aligned.

In double-entry accounting:

Debit entries are usually on the left side.

Credit entries are on the right.

Each account type has a natural tendency to grow on one of those aspects - this is its Normal Balance.

Five Types of Accounts and Their Normal Balance

Accounting rotates around five primary types of accounts, each with a defined Normal Balance:

Assets - Normal Balance: Debit

Assets include cash, inventory, assets and equipment. These accounts grow with debit.

Liabilities - Normal Balance: Credit

Liabilities such as loans, payable accounts, or earned expenses grow with credit.

Equity - Normal Balance: Credit

Swamy's equity or intact earnings naturally grow on the credit side.

Revenue - Normal Balance: Credit

Sales or service income accounts increase with credit.

Expenses - Normal Balance: debit

Operating costs such as rent, salary and utilities increase with debit

Understand the Normal Balance of Accounts

The argument behind the Normal Balance of Accounts revolves on how each transaction affects accounting equation:

Assets = Liabilities + Equity

If any expenses increase, it reduces equity. If revenue increases (a credit), it increases equity. Maintaining a normal balance ensures that this equation is always in balance.

A Practical Example of Normal Balance

Suppose a company office supplies in cash of $ 1,000:

Office supply (asset) increases → Debit $ 1,000

Cash (asset) decreases → Credit $ 1,000

Here, both accounts maintain their normal balance amount: office supply up (debit), and cash down (credited), keeping the books balanced.

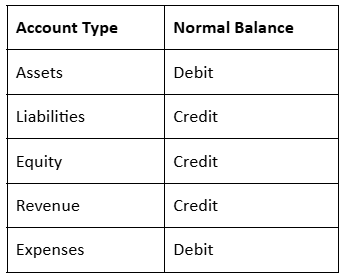

Normal Balances of Accounts Chart

This chart is a quick-content tool for anyone working with accounting entries or produces a three-state model.

Effect of Understanding Normal Balance

Normal balance improves:

Financial Modeling Accuracy: Input in your balance sheet, income statement, or cash flow statement remains consistent.

Finding the Error: When you know that it becomes easy to spot discrepancies, should the side value be increased.

Systematic Thinking: strengthens its understanding of transaction flow in accounting.

Software Efficiency: Helps you navigate the accounting software such as quickbook or zero with more clarity.

Conclusion

The Normal Balance is not only an accounting technical - it is the backbone of reliable financial reporting. Whether you are managing bookkeeping method, building financial models, or accounting is learning the basic things, a strong understanding of Normal Balance ensures accuracy and logic in your record. It is one of the concepts that converts confusion into confidence, which helps you speak the real language of numbers.

Write a comment ...